Introduction to DCI

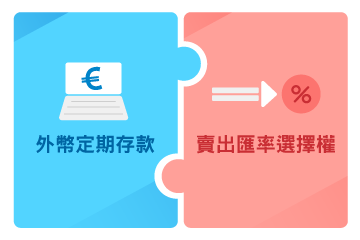

Dual-Currency Investment (DCI) is a foreign exchange product that involves two currencies, and combines "foreign currency time deposit" and "currency option."

Product features

Low investment threshold

- Make transactions reaching the equivalent of US$10,000 and above via Internet/mobile banking!

- No service fees and management fees

Short-term investment

- High flexibility flexible funding operation

- 1 week, 2 weeks, 3 weeks, 1 month, 2 months

Multiple currencies to choose from

- Transactions can be made in 10 currencies

- USD, EUR, GBP, AUD, NZD, JPY, CAD, ZAR, CHF, and MXN

Freely choose the terms and conditions of the product and time of transaction.

- Select the transaction currency, underlying currency, investment tenor, exchange rate, and product income

- Internet/mobile banking transaction time of 09:00~23:00 provides greater flexibility

Investment Must-knows

Comparison of investment products

| Investment Product | DCI | FX time deposit | Funds | Stocks |

|---|---|---|---|---|

| Investment risk | Moderate | Low | Moderate | High |

| Term of investment | Short | Long | Long | Short |

| Investment gains | Moderate | Low | Moderate | Long |

- The currency put option of DCI gives you an opportunity to receive better return than general foreign currency time deposits.

- DCI transactions involve risks from exchanging the principal between different currencies, so the principal is not guaranteed (the minimum guaranteed principal is 0% for professional investors and 70% for retail customers).

Utilization of DCI Investments

| DCI investments involve risks from exchanging the principal between different currencies (such as: USD converted to EUR). |  |

Suitable for those who need the underlying currency need after the principal is exchanged into a different currency (such as: EUR can be used for investment, travel, study abroad, or payments) |

| The investment term of DCI is short (as short as one week) and gives you an opportunity to receive better return than general foreign currency time deposits. |  |

DCI is suitable for flexibly operating funds during periods in between investments. |

DCI taxation method

| Individual | Legal person | ||||

|---|---|---|---|---|---|

| DBU | OBU | ||||

| Residents of the R.O.C. | Non-Residents of the R.O.C. (Resides in the R.O.C. for less than 183 days a year) | Has a fixed business location in the R.O.C. | Does not have a fixed business location in the R.O.C. | ||

| Tax | 10% taxed separately | 15% taxed separately | 10% taxes withheld are included in profit-seeking enterprise income | 15% taxes withheld do not need to be included in profit-seeking enterprise income | None |

| 2nd Generation NHI supplementary premium | Exempted | Exempted | N/A | N/A | N/A |