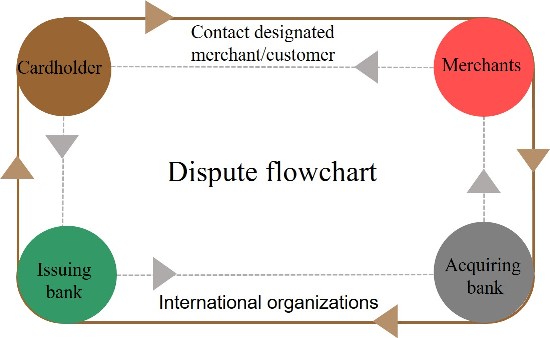

處理流程

- Cardholder/Customer

The customer hopes that the Bank will help file a claim for a dispute with a designated merchant (such as: card was fraudulently used, did not receive the products/services, etc.).

- The customer must prepare documents within 15 business days after being charged by the merchant based on the international organization timeframe (see the application for E. SUN credit cards).

- Merchants

The designated merchant provides the acquiring bank with evidence to counter the claim (such as: communication records with the customer, terms and conditions of the transaction).

- Issuing bank

The issuing bank sends a dispute request to the acquiring bank according to regulations of the international organization for dispute resolution within the prescribed time limit using disputed documents provided by the customer.

- Acquiring bank

- Receives the consumer dispute document from the issuing bank

- Notifies the designated merchant that a customer reported a transaction dispute and demands a refund, and provides related documents to the issuing bank to confirm whether to accept or reject the request.