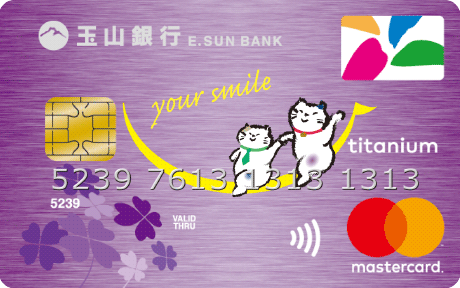

Card introduction

Accumulate E.SUN credit card bonus points

- For new general consumption, 1 point will be accumulated for every NT$25 or more in a single transaction. Any amount less than NT$25 will not be counted (i.e., no reward will be granted if the amount is less than 1 point after calculation) and cannot be accumulated for the next period (inclusive) for combined calculation. The same rules apply to bonus points doubling events.

- Please refer to the reward point redemption descriptions for details on accumulation and redemption of bonus points.

- The event is limited to new general consumption. Please refer to the announcement on the official website for details of items not included in the general consumption.

- If not specified, all calculations are done in NTD.

- E.SUN Bank reserves the right to modify, change or terminate the event.

One card GO with EasyCard function

It can be used at some domestic gas stations, food courts, supermarkets, movie theaters and other special stores. Purchases under NT$3,000 can be settled without a signature. No more card swiping, no more signature. It’s fast and convenient.

It can be used at four major convenient stores, drugstores, coffee shops, and other 10,000 stores that accept small amount payment with an EasyCard. You don't need to bring change and GO around with one card! You can also enjoy various exclusive offers!

Annual Fee

Titanium / Signature Card: NT$3,000 / card, Platinum Card: NT$900 / card, NT$300 / for Standard card (free annual fee for the first year, free for the supplementary card). Electronic billing service and credit card bill autopay from E.SUN accounts are entitled to an annual fee waiver.

Annual Fee Concessions: Annual fee will be waived in the second year for combined annual transaction amount from the primary and supplementary credit cards (including auto load) of NT$30,000 or 6 times or above with Titanium / Signature / Platinum Card; NT$10,000 or 2 times or above with Standard card.

The annual fee waiver threshold does not include the following transactions: non-purchase items such as cash advances, compensations, collections for third parties, operating expenses/handling fees, refund/sales returns, card loss report fees, card production fees, annual fees, revolving credit interest, service costs, default penalties, and disputed transactions. For installment payment transactions, only the first installment will count as a completed purchase, but the total amount will still be aggregated.