Message from Chairman

Establish a culture based on fair customer treatment principles

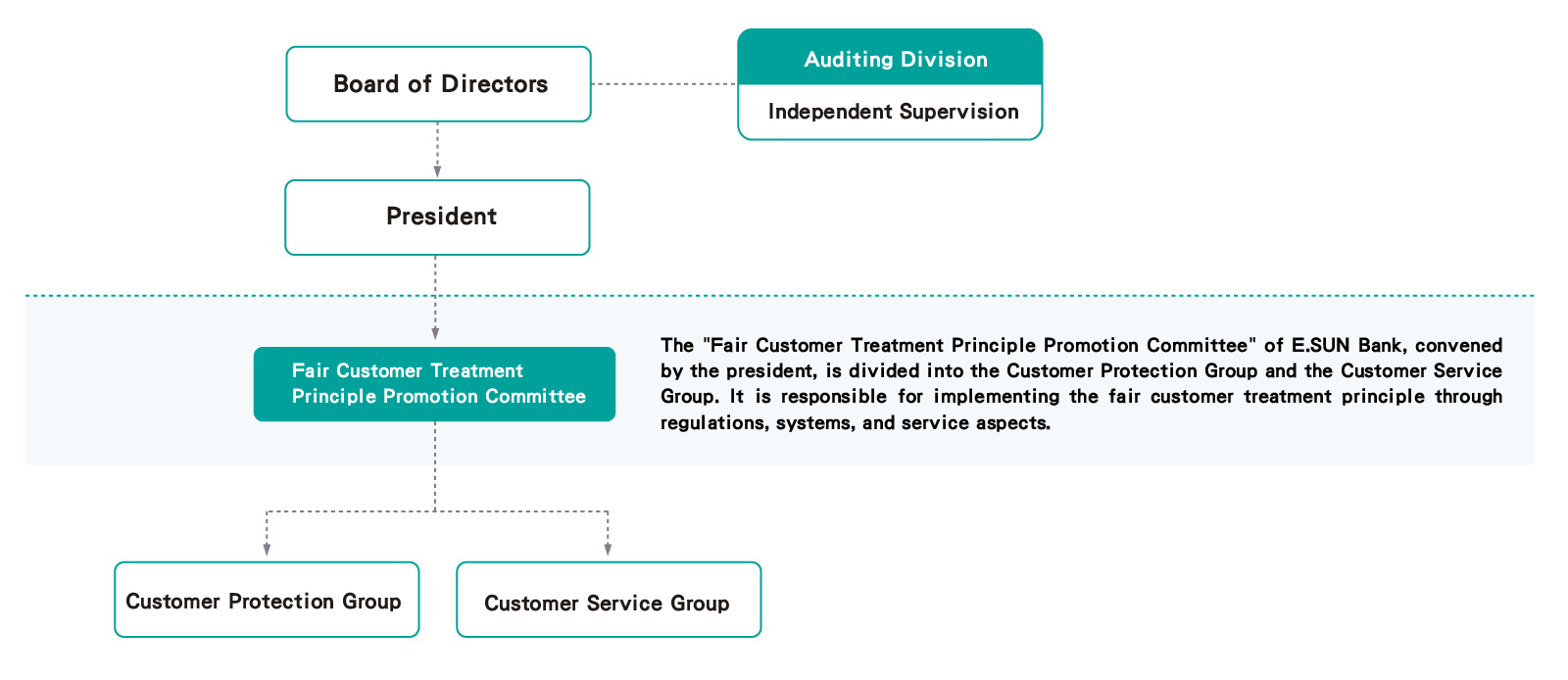

While developing its business operation, E.SUN continuously seeks to establish a culture based on fair customer treatment principles. These principles are customer experience-oriented to ensure service quality, implement customer protection, and improve customer communication and interaction. Apart from assisting customers in accurately understanding E.SUN’s products and services, we also strengthen customer information disclosure. Furthermore, we strive to understand and care for customers through diverse communication channels. These are part and parcel of our efforts to continuously refine customer experience.

Establish heartwarming customer services

E.SUN's business philosophy is rendered as “cultivating professional banking talent and offering its customers the highest quality of service.” Good service is in the DNA of every E.SUN employee. E.SUN is committed to becoming “a benchmark for the financial and service industry.” As such, E.SUN designs each financial service process from the customer perspective, and establishes diversified service channels to listen to customers' voices and needs. In recent years, in response to the trend of focusing on customer rights, benefits and experience, E.SUN has continued to keep up with the times by establishing a customer service management system. With a comprehensive service quality management, we seek to create heartwarming customer service and pleasant experiences, providing products and services that better meet customer requirements.

Proactively develop inclusive financing and provide convenient financial services through digitization

By leveraging its core competencies in the financial operation, E.SUN Bank creates on tap financial services that are immensely convenient, and lowers the threshold for the general public to access its services. This will enable individuals or business owners with different backgrounds to benefit from the appropriate financial services underpinned by our open, equal and diverse foundation. Not only do we leverage the ubiquity of digital banking and loans to SMEs to support employment and economic development, we also offer barrier-free environment and support the underprivileged. All of which are part of our efforts to eliminate poverty and inequality in society, thereby boosting a robust development of society and economy by utilizing the strengths of our financial operation.

Motivated to become a “top-performing and most respected company”

E.SUN FHC has been proactively and consistently practicing sustainable finance and responsible finance, and will continue to conquer the three challenges of business operation: overall performance, corporate social responsibility and sustainable development. E.SUN is dedicated to promote environmental, social and governance (ESG) goals. Whether it is undertaking challenges or seizing opportunities, E.SUN will adopt a modest and progressive manner to make adjustments and seek progresses. Furthermore, E.SUN will uphold its core values, integrate internal and external resources and strengths of our partners. By working together with various parties, E.SUN aspires to create a better future.